What does open data reveal about renewable hydrogen?

An overview of the different applications of renewable hydrogen through open data

Hydrogen is the simplest and most abundant element in the universe and can be a versatile energy source once separated from other elements. It can be produced from many resources, including fossil fuels, nuclear energy, biomass and renewable energy sources. When burned, hydrogen emits only water.

However, producing it from fossil fuels like coal and natural gas results in significant carbon dioxide emissions. In contrast, renewable hydrogen, also known as clean hydrogen, is made by using renewable electricity (e.g. wind, solar and hydropower) to split water into hydrogen and oxygen through a process called electrolysis. While the availability of such renewable sources can fluctuate significantly, the hydrogen produced can be effectively stored for extended periods, similar to how a battery stores energy, and used later. This capability allows renewable hydrogen to enhance the flexibility and efficiency of energy systems by balancing supply and demand fluctuations, whether there is an excess or a shortage of power generation.

Under the European Green Deal and the goal of net zero emissions by 2050, the EU’s 2020 hydrogen strategy and repowerEU plan aim to promote renewable and low-carbon hydrogen. This will reduce the EU’s reliance on imported fossil fuels cost-effectively. To ensure hydrogen is produced from renewable sources and achieves at least 70 % greenhouse gas emissions savings, the European Commission adopted detailed rules in June 2023. These rules define renewable hydrogen for both domestic and international producers exporting to the EU.

In this data story, we use open data to explore the role of hydrogen in the renewable energy market and the EU’s decarbonisation strategy. We look at the current status of hydrogen consumption and trade, along with its use in fuelling electric vehicles.

Open data on hydrogen demand in the EU

In 2022, the total demand for hydrogen in the EU was estimated at 8.2 million tonnes (mt). Hydrogen made up less than 2 % of Europe’s energy consumption. The largest share of hydrogen demand came from refineries (57 % or 4.7 mt) and the ammonia industry (24 % or 2.0 mt), which are key for producing chemical products like plastics and fertilisers.

In terms of production, approximately 96 % of the total hydrogen consumed in the EU was produced using natural gas, which leads to carbon dioxide emissions. Emerging use cases for clean hydrogen, such as mobility, steel production and e-fuels, are still relatively few, but are expected to increase as the production of clean hydrogen grows.

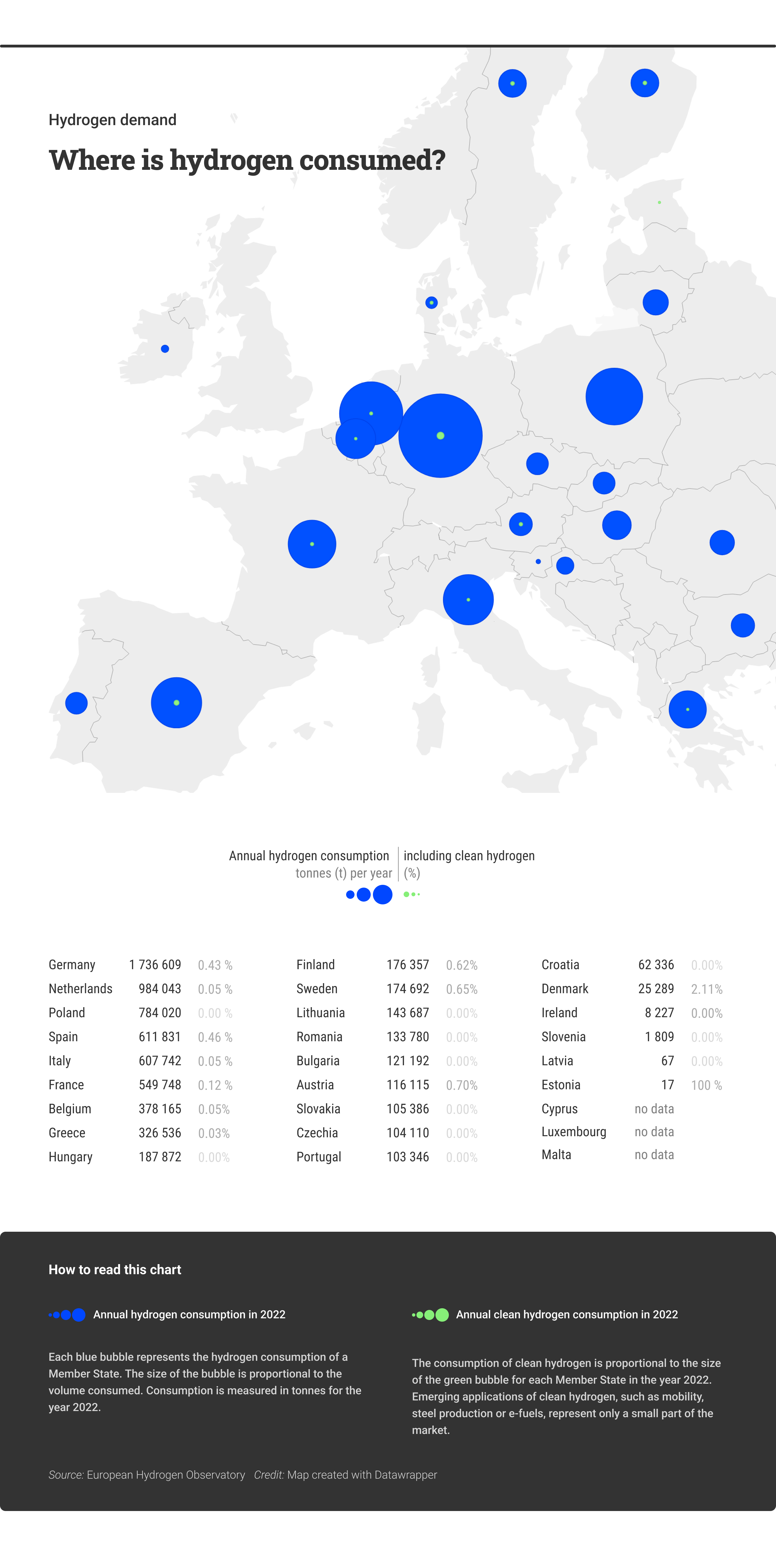

Germany (21 %), the Netherlands (12 %), Poland (10 %) and Spain (8 %) accounted for over half of EU’s total hydrogen consumption. However, when looking at clean hydrogen consumption, Estonia led with 100 % of its hydrogen consumption being clean hydrogen, followed by Denmark (2.11 %), Austria (0.70 %), Sweden (0.65 %) and Finland (0.62 %). This shows a significant gap between Estonia and the other countries, as can be seen in Figure 1.

In 2022, the total production of renewable hydrogen in the EU was still negligible, at around 0.2 % of the total hydrogen produced (8.2 mt). The EU’s hydrogen strategy focuses on renewable hydrogen, aiming to produce 10 mt and import another 10 mt by 2030. While there is still a long way to go, there is the potential to reach this goal if all the projects that have been announced are implemented. In the steel sector, clean hydrogen consumption could reach 2 mt/year; the ammonia sector has announced projects totalling 2.1 mt/year of clean hydrogen consumption; and the refining sector has announced that consumption will reach 1.2 mt/year by 2030. Continue exploring how demand changes across Europe here.

Figure 1: Overview of hydrogen demand in the EU (Source: European Hydrogen Observatory)

Open data on Europe’s hydrogen trade

Currently, most of the hydrogen produced in Europe is directly used at the site where it is made, known as a captive market. However, thousands of tonnes of hydrogen are also traded and distributed around Europe via dedicated pipelines or trucks, and these trade flows are expected to increase.

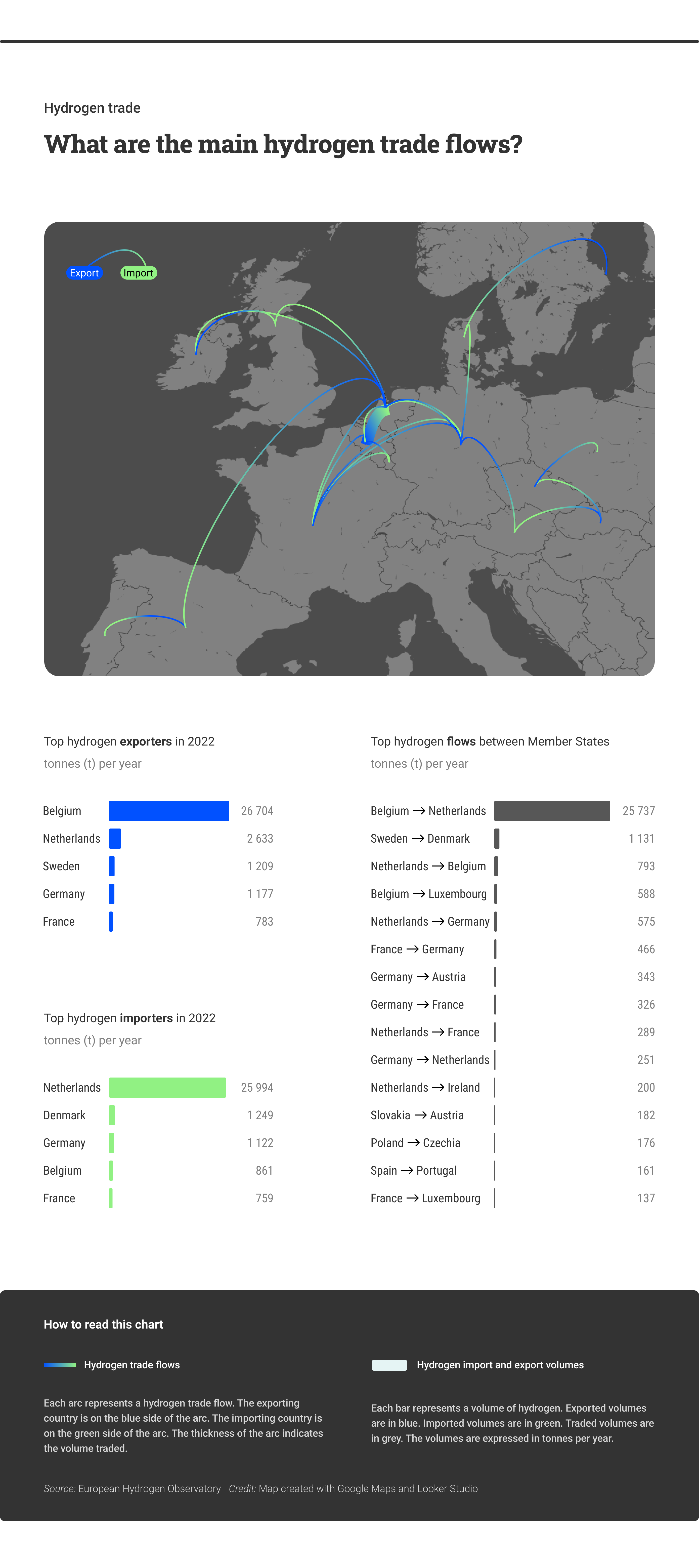

As shown in Figure 2, the main hydrogen trade routes are concentrated in northern Europe. In 2022, the Netherlands was the largest importer, accounting for 76 % (25 994 tonnes) of the 34 173 tonnes of hydrogen traded in Europe. Along with Denmark (3.7 %), Germany (3.6 %), Belgium (2.5 %) and France (2.3 %), it represented over 88 % of European hydrogen imports. Belgium was the top exporter, accounting for around 75.3 % (25 737 tonnes) of all hydrogen exports, followed by the Netherlands (7.7 %), Sweden (3.5 %), Germany (3.4 %) and France (2.3 %).

The largest hydrogen trade route was from Belgium to the Netherlands, making up 75 % (25 737 tonnes) of all hydrogen traded in Europe. Other significant routes included Sweden to Denmark (3.3 %), the Netherlands to Belgium (2.3 %), Belgium to Luxembourg (1.7 %) and the Netherlands to Germany (6.7 %). These comprised 84 % of European hydrogen trades in 2022.

Recent initiatives aim to integrate southern EU Member States into the hydrogen network to boost consumption and trade across the EU. In May 2024, Germany, Italy and Austria agreed to build a ‘southern hydrogen corridor’, advancing the EU’s strategy to secure renewable hydrogen supplies by 2030. Continue exploring hydrogen trades in this interactive dashboard.

Figure 2: The main hydrogen trade routes across Europe (Source: European Hydrogen Observatory)

Open data and hydrogen fuel cell electric vehicles

Transportation is essential to our economies. However, it accounts for about a quarter of the EU’s total greenhouse gas emissions. Decarbonising this sector is crucial and can be achieved through direct electricity use, hydrogen or hydrogen derivatives. Hydrogen fuel cell electric vehicles are a valuable alternative within the broader category of electric cars. These vehicles produce electricity using a fuel cell powered by hydrogen, rather than drawing electricity only from a battery. They also offer further benefits compared to conventional battery electric vehicles, such as faster refuelling times and longer ranges, along with higher efficiency for larger vehicles compared to both gas and electric cars.

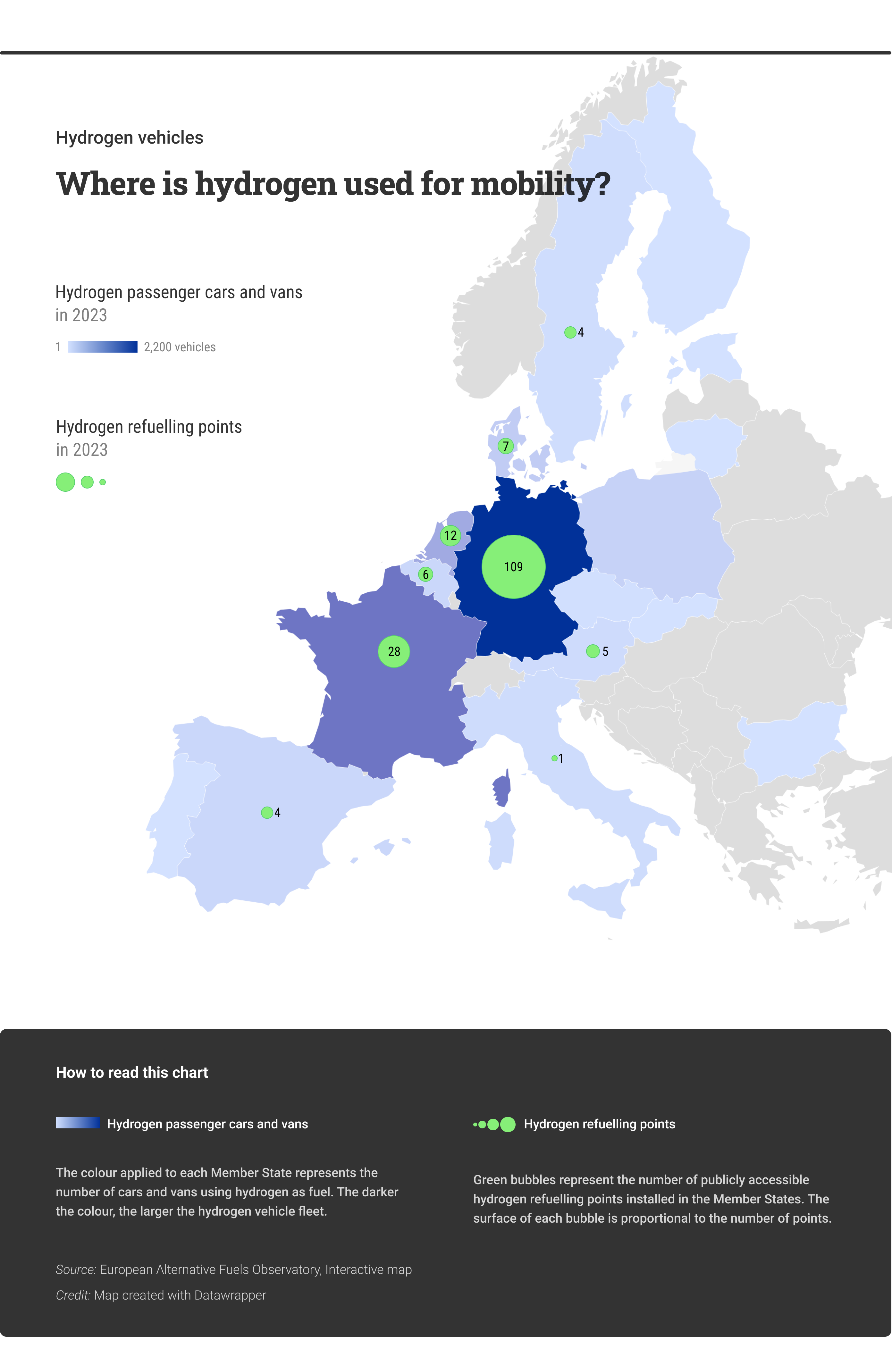

Hydrogen personal vehicles have seen steady but slow growth over the years. In 2023, the EU market for hydrogen passenger cars and vans amounted to a total number of 4 399 units. As figure 3 shows, Germany accounted for the largest hydrogen fleet (with 2 187 vehicles or nearly 50 % of total EU fleet). It is followed by France with 1 274 vehicles.

Hydrogen refuelling stations (HRSs) are critical for hydrogen-powered mobility. Without a widespread hydrogen refuelling network, hydrogen vehicles are greatly limited and cannot be widely distributed. The number of HRSs in the EU is increasing, with most of them located in Germany (109), France (28) and the Netherlands (12). Under the alternative fuels infrastructure regulation, the EU requires enhancing the deployment of HRSs by 2030, including one station every 200 km on the core trans-European transport network and one per urban node.

Figure 3: Distribution of hydrogen fuel cell electric vehicles across the EU (Source:European Hydrogen Observatory)

Conclusion

Open data is crucial for analysing current phenomena, providing transparency and insights into hydrogen’s role in Europe’s energy transition. The visualisations of this data story highlight three key messages: the current demand for and potential production of renewable hydrogen, the potential for hydrogen trade and the potential of hydrogen to decarbonise the mobility sector. By leveraging open data, we can make informed decisions to drive sustainable energy solutions. We encourage you to explore and use open data to stay informed and engaged. Subscribe to our newsletter and follow data.europa.eu on social media for the latest updates.