Exploring housing trends with open data

What the data shows about housing costs, who rents or owns and who’s left behind in the energy transition

Homes are where people spend most of their time, shaping their comfort, security and quality of life. However, finding and being able to afford a suitable place to live has become increasingly difficult across Europe. Rising prices and the changing economy are putting pressure on households in many Member States.

To address these challenges the European Commission President Ursula von der Leyen announced the European affordable housing plan during her 2025 State of the Union address: a coordinated effort to make housing more accessible, improve quality and support renovation across the EU.

This data story takes a closer look at the state of housing in Europe today: how much people pay, how they live and how energy-efficient their homes are.

Where housing hits the hardest

Housing costs are a key factor in financial stability and quality of life across Europe – affecting not just where people live but also how much is left for other essentials.

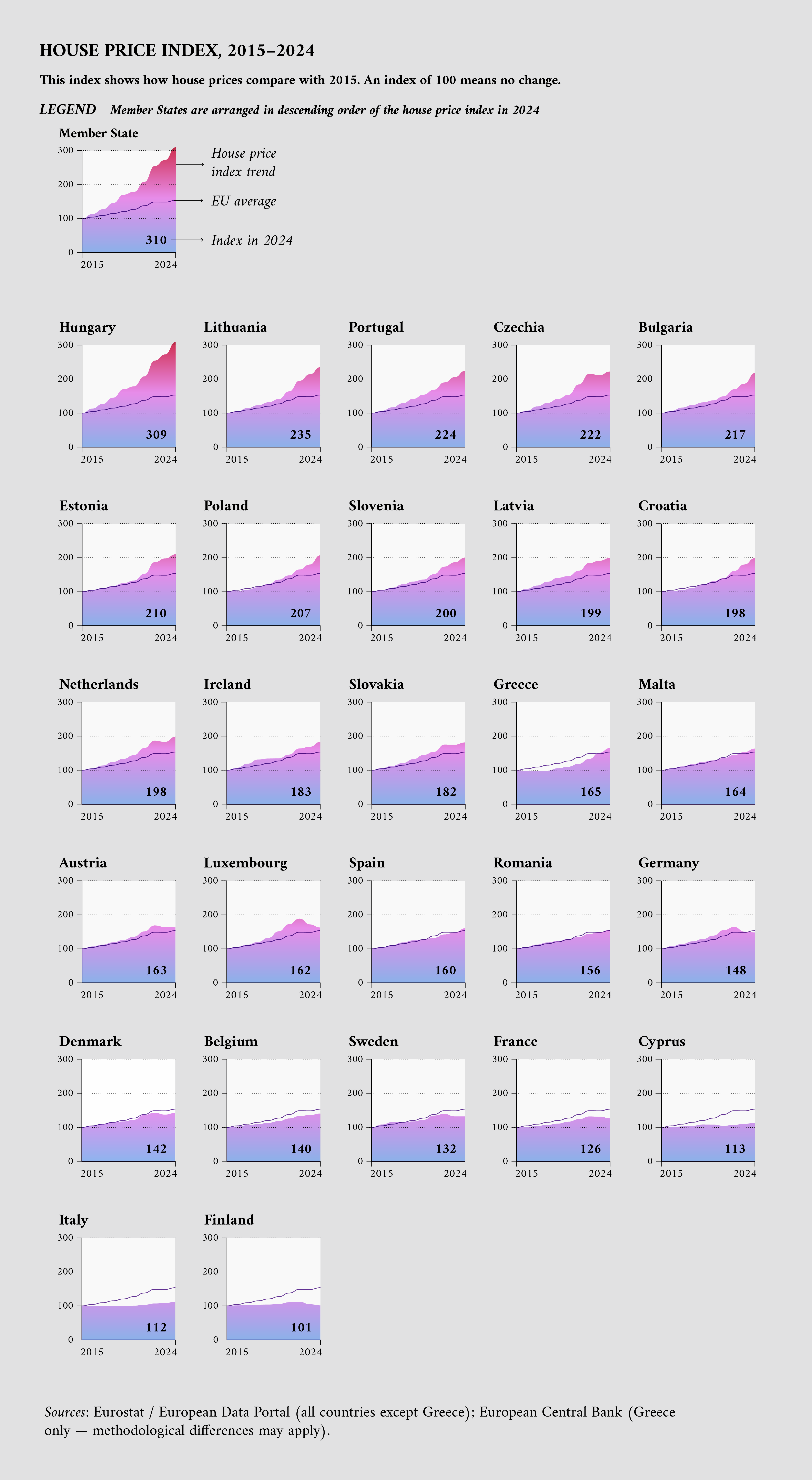

Between 2015 and 2024, average house prices in the EU rose by 58 %. As Figure 1.1 shows, the increases vary widely: in eight Member States prices more than doubled, and in Hungary they more than tripled. On the other hand, in Member States such as Cyprus and Italy, price growth was lower than general inflation, while in Finland prices barely moved. In many Member States, most of the increase occurred before 2021, followed by a period of stabilisation – or even decline – in recent years.

Figure 1.1: Housing price index (2015–2024)

Source: Eurostat / European Data Portal, European Central Bank.

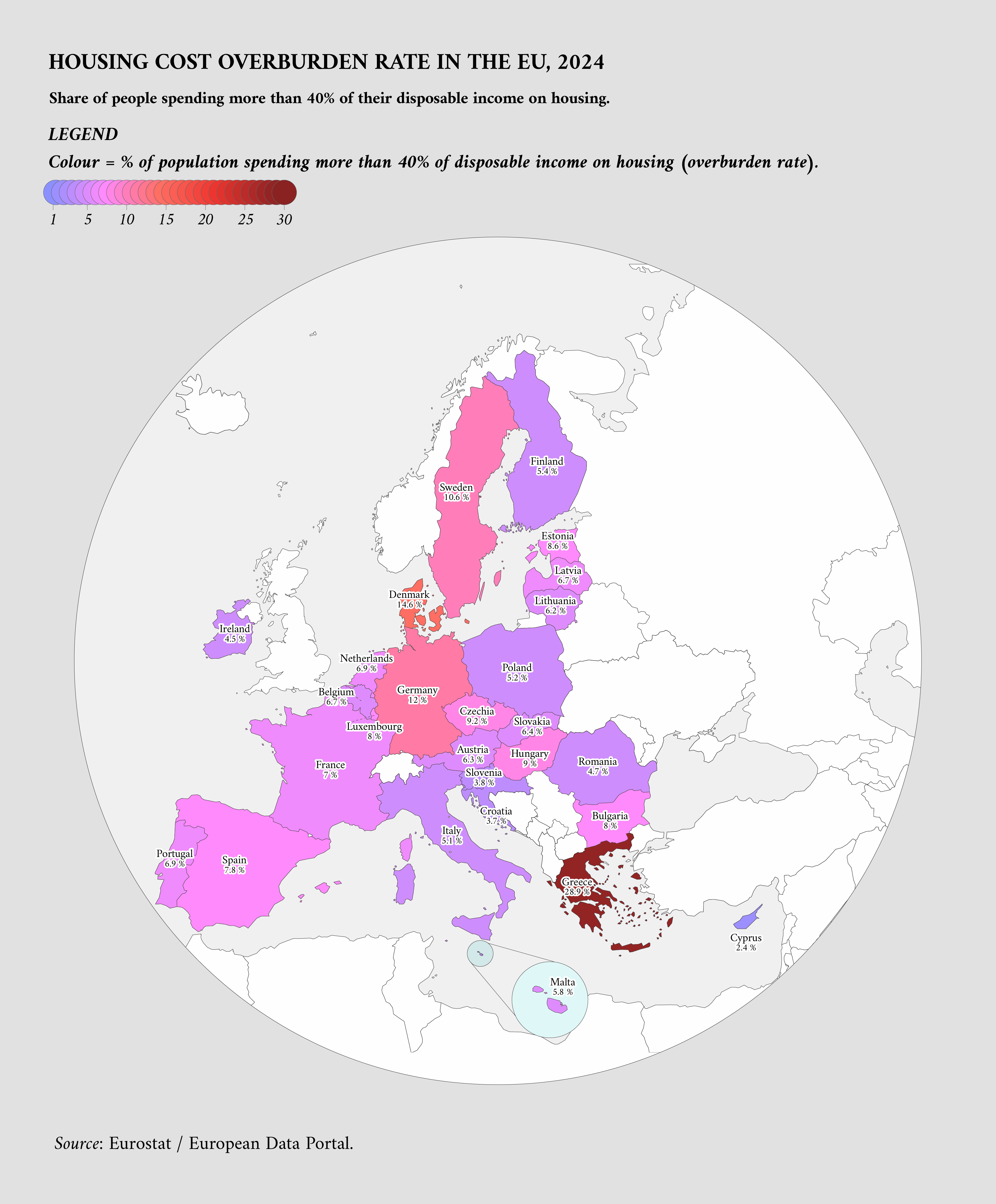

Rising prices alone don’t tell the whole story. Affordability also depends on income. One key indicator to take this into account is the housing cost overburden rate – the share of people spending more than 40 % of their disposable income on housing. The EU average is 8 %, but national differences are striking, as Figure 1.2 shows. Beyond these national averages, large regional gaps also exist, with housing in cities generally much less affordable than in rural areas.

In Greece, 29 % of people face this burden – the highest in the EU. Higher income Member States are not immune: in Denmark, 14.6 % of the population spends more than two fifths of their income on housing despite relatively high wages. At the other end of the scale, Slovenia (3.8 %), Croatia (3.7 %) and Cyprus (2.4 %) report the lowest rates, pointing to comparatively more affordable conditions.

Figure 1.2: Housing cost overburden rate in the EU (2024)

Source: Eurostat / European Data Portal.

While prices may be stabilising, the strain on households remains. The data shows that housing affordability continues to pose a major challenge, especially in Member States where incomes have not kept pace with housing costs.

Who rents and who owns in Europe?

Housing costs are rising and so are shifts in how people live. Whether renting or owning, the way Europeans access housing is closely tied to affordability, mobility and market pressures.

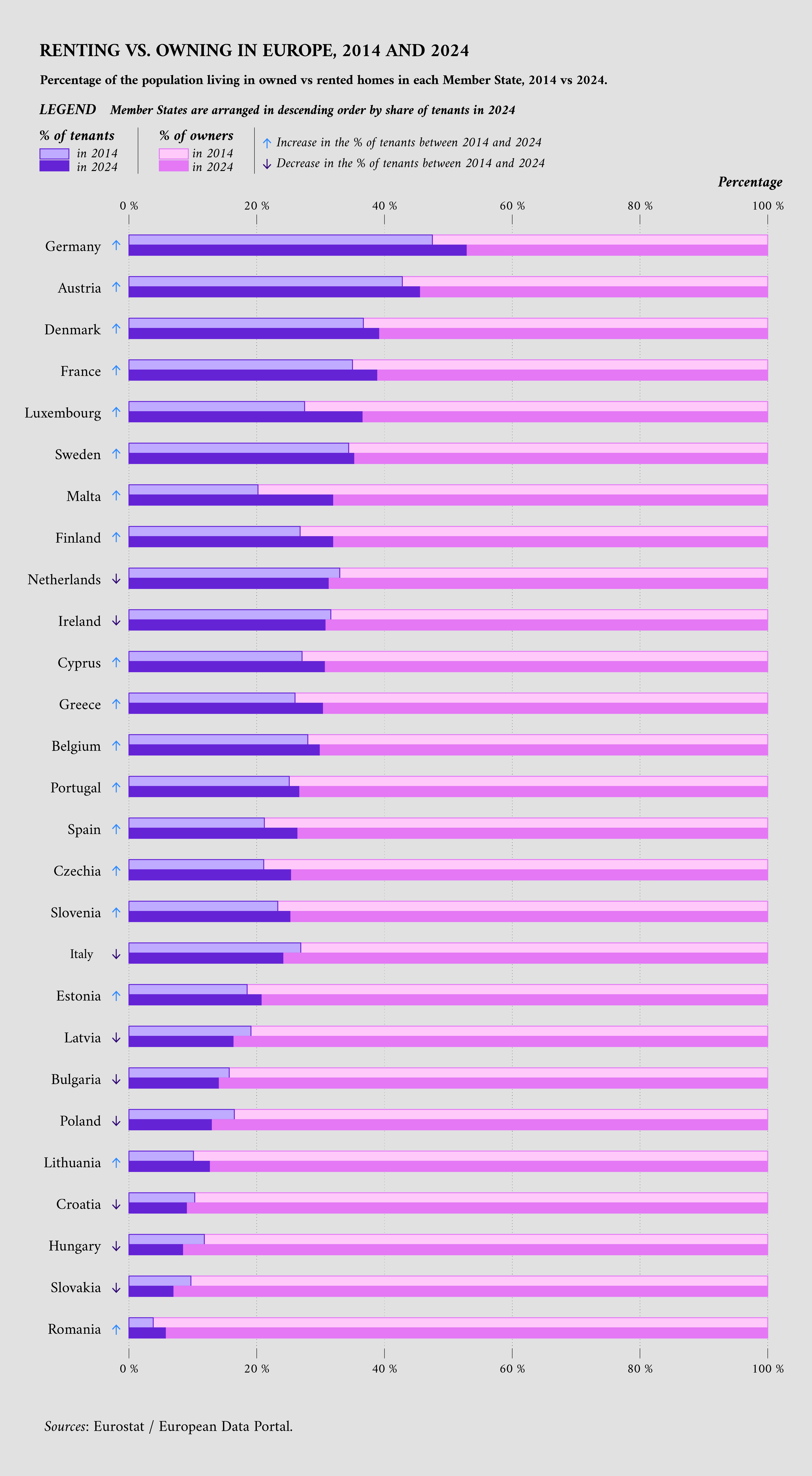

As shown in Figure 2, owning a home remains the dominant model across the EU, but the balance between owners and tenants varies widely. The lowest ownership rates are found in Germany (47 %) and Austria (55 %). Both countries have long-established rental markets and strong tenant protections, making renting a more stable and common option, particularly in urban areas.

At the other end of the spectrum, more than 90 % of residents in Romania, Slovakia, Hungary and Croatia live in homes they own. This pattern is rooted in the mass privatisation of public housing in the 1990s, which created high levels of ownership. In many of these countries, rental markets remain relatively small or informal, especially outside major cities.

In recent years, a slow but steady shift has taken place. Between 2014 and 2024, the share of tenants increased in most Member States. The largest rises were in Malta and Luxembourg, where renting grew by nearly 12 and 9 percentage points, respectively. However, in 9 out of the 27 Member States homeownership increased, most noticeably in Poland and Hungary (3.6 and 3.4 percentage points, respectively).

These trends point to a gradual but uneven shift in how Europeans access housing. In most Member States, renting is becoming more widespread, often driven by rising prices and limited access to ownership. For many, especially younger people and urban residents, renting is no longer just a transitional phase, but a longer-term reality shaped by affordability.

Still, the picture is not uniform: homeownership continues to grow in some Member States. The gap between renter-heavy and owner-heavy Member States remains wide, but small shifts are blurring the lines as renting becomes more common even in traditionally owner-dominated societies like Malta.

Figure 2: Change in renting and owning across the EU (2014–2024)

Source: Eurostat / European Data Portal.

Are homes in Europe becoming more energy efficient?

Housing affordability isn’t just about rent or mortgage payments, it’s also about the cost of keeping a home liveable, especially when energy bills rise. In that sense, energy efficiency is a key part of the housing equation. However, many Europeans still live in dwellings with poor insulation and high energy needs.

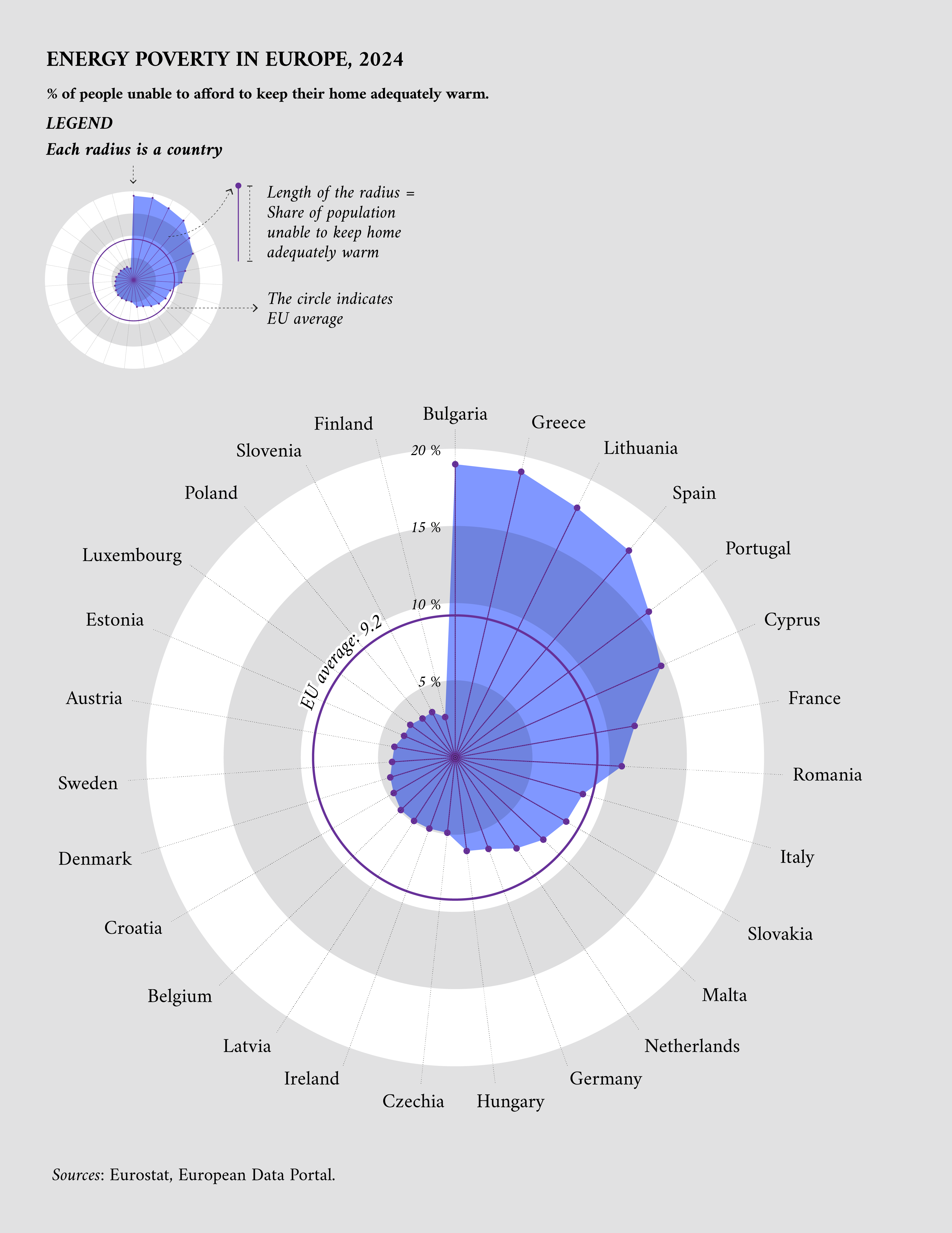

In 2024, 9 % of people across the EU said they couldn’t afford to keep their home adequately warm. That share jumps to nearly 20% in Bulgaria, Greece and Lithuania, adding a hidden cost to living conditions in countries already facing housing pressure.

Figure 3.1: Share of people unable to afford adequate heating in Europe (2024)

Source: Eurostat / European Data Portal.

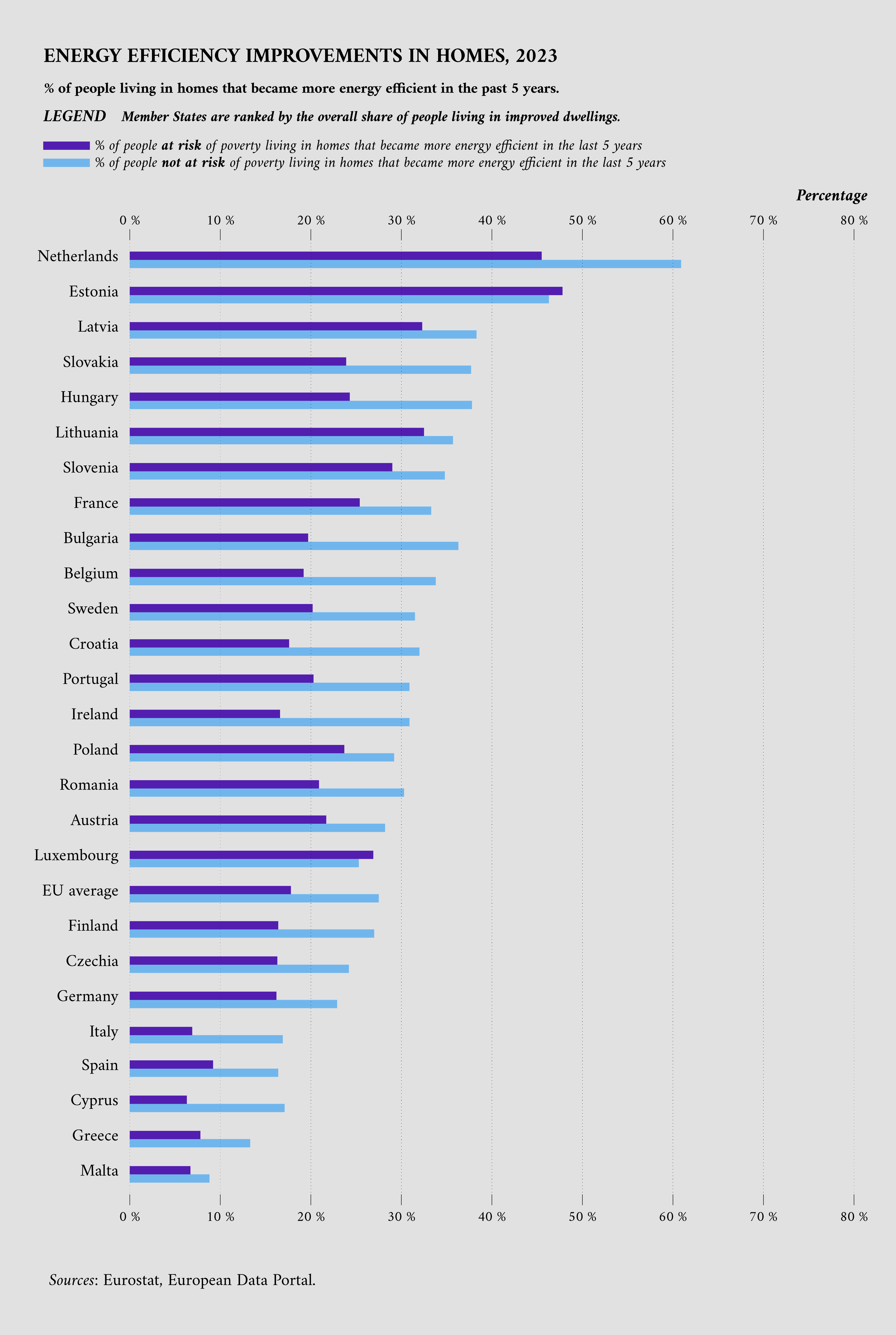

One way to ease the burden is through renovations that improve energy performance. Across the EU, 18 % of people at risk of poverty now live in homes that became more energy efficient in the past five years. For those not at risk, the figure is 28 %. The pattern is clear: the people who would benefit the most from energy savings are often the least likely to get them.

Differences between Member States are wide. The Netherlands leads, with energy efficiency improvements in about 59 % of dwellings, followed by Estonia with 47 %. At the lower end, only 8 % of homes in Malta, 12 % in Greece and 15 % in Spain saw improvements, a pattern partly linked to milder climates where heating plays a smaller role. In most Member States, renovation rates are consistently higher for wealthier households. Only Estonia and Luxembourg are exceptions, where improvements reached low-income residents slightly more often.

Figure 3.2: Share of people living in more energy-efficient homes, by poverty status (2023)

Source: Eurostat / European Data Portal.

Energy-efficient homes reduce bills, lower emissions, and protect against poverty. But today, they remain more accessible to those already better off. As Europe pushes for greener and more affordable housing, ensuring that renovations reach vulnerable households is not just a climate goal, it’s also a social one.

Conclusion

Housing in Europe is at a crossroads. As prices rise and energy costs weigh on households, access to decent, affordable and efficient homes is becoming more uneven. On average, more people are turning to renting, but this is not a universal trend.

While some Member States have made strides in improving housing quality and expanding energy renovations, others lag behind. The data reveals not only stark differences between Member States, but also widening gaps within them. Open data helps make these imbalances visible. Addressing them will require sustained investment, policy coordination and a strong social focus. Ensuring that every European has a place they can afford, keep comfortable and live in with dignity is not just a matter of fairness, but also one of prosperity and well-being.